‘McKinsey’ has calculated that the total addressable trade finance market could be in the region of USD$ 10 trillion of assets (growing at a rate of circa USD$ 45 billion per year, or close to 5%). However, it is also estimated that only 10% of those trade assets are financed.

Trade finance means many things to many people. McKinsey terms include from pre-shipment to post-shipment receivables, the whole trade cycle. The significant gap in the trade finance cycle is in the early stages of the cycle i.e. pre-shipment financing. This can be categorised as “traditional trade finance” and supply chain finance. See McKinsey 2020 Global Payments Report for a good overview.

Historically the traditional trade finance sector has been financed through large financial institutions, normally banks, on a deal by deal basis through a number of mechanisms 1) cash advance, payment prior to goods been shipped 2) open account trade – transfer of funds directly to the supplier following the arrival of goods 3) documentary collection – transfer based on shipping documents confirmed by the participating bank 4) letter of credit –are financial, legally binding instruments, issued by banks or specialist trade finance institutions offering a guarantee of payment based on certain performance criteria. Trade Finance Global “TFG” have excellent educational information on the various forms of trade finance and how it works.

Supply chain finance or reverse factoring is the financing of multiple suppliers normally into a large buyer for example pharmaceutical companies. Again, traditionally the banks have provided finance, through large supply chain platforms, against the receivables. Although increasingly private credit lenders have moved into the sector with new digital platforms.

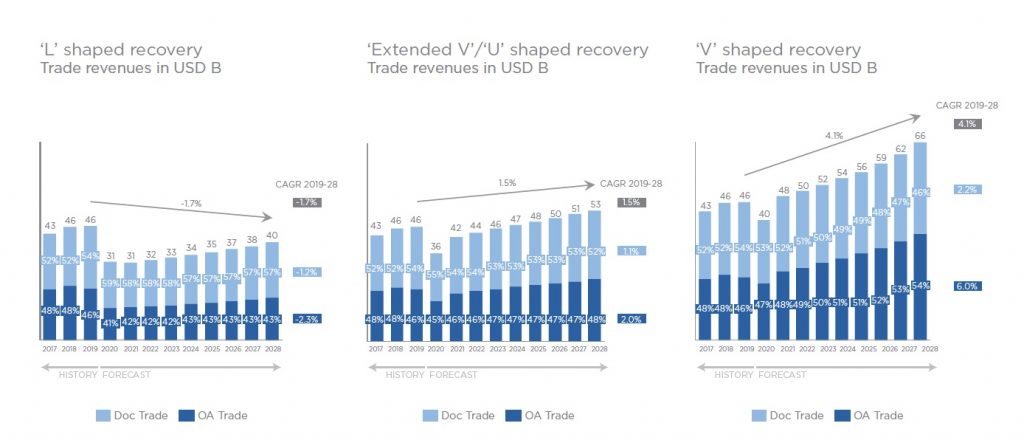

This article is focused on the outlook for traditional trade finance sector. According to ICC Trade Finance report, revenues increased by 1% to USD$ 46 billion in 2019. This was due to a 6% growth in documentary trade revenues. Open account revenues, by contrast, were down 4%. This reversed the trend of recent years in which revenues have shifted from documentary to open account trade. The most likely explanation is that trade tensions between the U.S. and China have increased uncertainty in supply chains and, hence, the demand for the risk mitigation supplied by documentary trade products. Shifting from familiar suppliers in China to new suppliers in Vietnam or Thailand is also likely to increase demand for documentary trade, at least until the new relationships are well established.

The uncertainties created by the Covid-19 pandemic is expected to sustain increased demand for documentary trade over the short-to-medium term (as demand for these trade products tends to be countercyclical). In fact demand is expected to be even greater for documentary trade than it was in the 2008 financial crisis because the Covid-19 pandemic is more far-reaching, with grave economic consequences in all regions of the world.

The uncertainties attendant on a difficult economic environment makes importers and exporters more willing to pay for risk mitigation provided by letters of credit and bank guarantees – which are generally higher margin than open account trade.

BCG Trade Finance Model, estimated share of documentary trade vs. open account trade, 2011-2028

Source: BCG Omnia Global Trade Finance Model 2020

These analyses represent only potential scenarios based on discrete data from one point in time (06 April 2020). They are not intended as a prediction or forecast, and the situation is changing daily.

According to 2019 ICC Trade Register report in the most severe scenario, documentary trade is expected to jump from 54% of the total in 2019 to 59% in 2020. This will soften the blow, but it will not suffice to avoid an absolute decline in trade finance revenues.

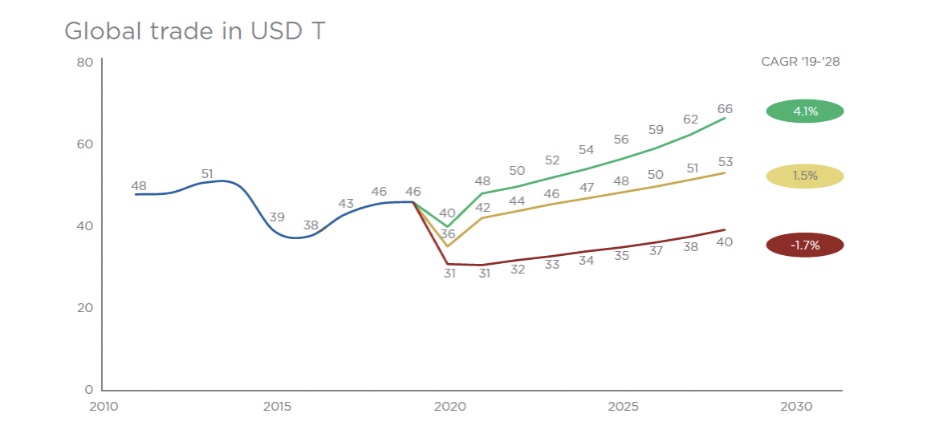

Diagram:

BCG Trade Finance Model, estimated global trade finance revenues, 2011-2028

Source: BCG Omnia Global Trade Finance Model 2020

These analyses represent only potential scenarios based on discrete data from one point in time (06 April 2020). They are not intended as a prediction or forecast, and the situation is changing daily.

Even in the best scenario, revenues may fall from USD$ 46 billion in 2019 to USD$ 40 billion in 2020 before rapidly increasing with the opening up of economies. Reduced revenues are unlikely to be the only effect of the Covid-19 pandemic on trade finance. In the short term, declining consumer demand and the disruption of supply chains will likely cause the default rate to spike. And banks will face calls for leniency, especially towards SMEs, which are expected to be the hardest hit.

However, small and medium sized business remain underserved in trade finance products by large financial institutions also competition from other finance houses is limited in the market. Following the 2008 financial crisis and the subsequent changes in regulation, especially concerning Basel 1-3, banks are required to hold more capital against their lending. This has significantly impacted the provision of lending for the working capital cycle. Products affected are trade finance, invoice discounting and overdraft facilities. As a result, traditional banks have focused on larger corporates due to pressure on their margins. In the past 10 years, there has been an increasing role for alternative and private credit lenders to step in and fill the gap. However, an overreliance on credit insurance and not focusing on old school underwriting, by some of the newer private credit lenders, has resulted in fewer number of providers especially in trade finance. As economies reopen post Covid and government supports are reduced, the question will be where the financial support for growth will come from, for small and medium sized business.